Oracle Financial Services Anti Money Laundering

Oracle Financial Services Anti Money Laundering allows financial institutions to efficiently detect, investigate and report suspected money laundering activity to comply with current and future regulations and guidelines. The application allows organizations such as banks, brokerage firms, and insurance companies to monitor customer transactions daily, using customer historical information and account and peer profiles to provide a holistic view of all transactions and activities.

Benefits

- Increase accuracy, reduce staff costs, and efficiently manage risk by isolating unusual behaviors and reducing false positive alerts

- Address multi-national regulations, guidelines & best practices from a single solution

- Efficiently detect, investigate & report suspected money laundering activity to comply with current & future regulations

- Provide regulators & key stakeholders a comprehensive view of financial activity & customer risk to transparently detect & investigate potential money laundering behavior

- Reduce compliance costs through sophisticated detection & streamlined investigations

Features

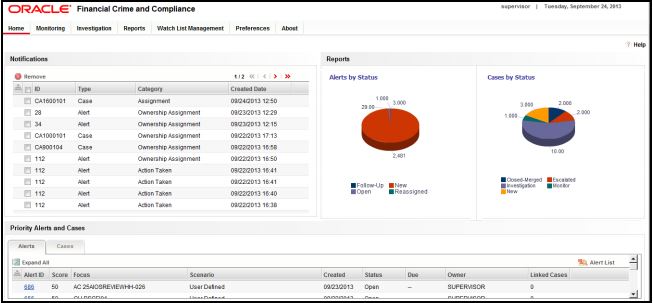

- Enterprise-wide risk based monitoring, investigations, and reporting for suspicious activities

- Industry-leading, comprehensive transparent behavior detection library

- Robust case management streamlines analysis, resolution and regulatory reporting in a single unified platform

- Constant investment in innovation to address regulatory changes and IT challenges

![]()