Oracle Financial Services Credit Risk Management

Oracle Financial Services Credit Risk Management enables institutions obtain a comprehensive view of credit risk across the organization including counterparty credit risk on trading book. The application aggregates credit data from multiple sources and eliminates data silos to achieve an enterprise-wide repository of credit risk information.

Benefits

- Accurately and comprehensively monitor credit risk and provide one version of the analytical “truth” to business users

- Enable strategic and operational decision making by providing CXOs and Line of Business managers with accurate information on cross-business and business-specific credit risk

- Achieve a single customer view of credit risk across exposures spread over multiple product types, lines of business, geographies & legal entities

- Leverage a unified, transparent and flexible analytical platform to meet emerging cross-risk business and regulatory requirements and business rules

Features

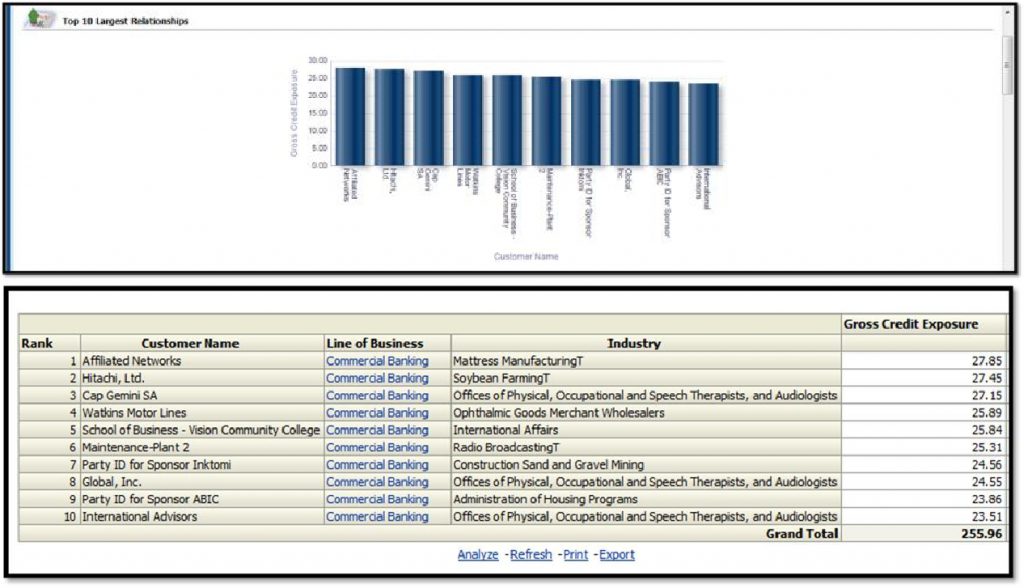

- 300+ pre-built credit risk reports and dashboards covering retail, wholesale and counterparty credit risk

- Includes reports on credit quality, reserves, delinquency, new business, risk migration, capital requirement & concentration

- Designed with extensive drill down capabilities to enable granular analysis of risk information

- Aggregates credit risk data across multiple sources and computes over 20 critical credit risk ratios

![]()