Oracle Financial Services Basel II Internal Ratings Based Approach

Providing open, quick, out-of-the-box and risk-free compliance with Basel II & III guidelines in multiple jurisdictions, Oracle Financial Services Basel Regulatory Capital also enables strategic decision making and capital planning with the extensibility to meet future regulatory requirements.

Benefits

- Quickly achieve Basel II & III compliance with a “ready-to-go” analytical application already live in over 70 countries

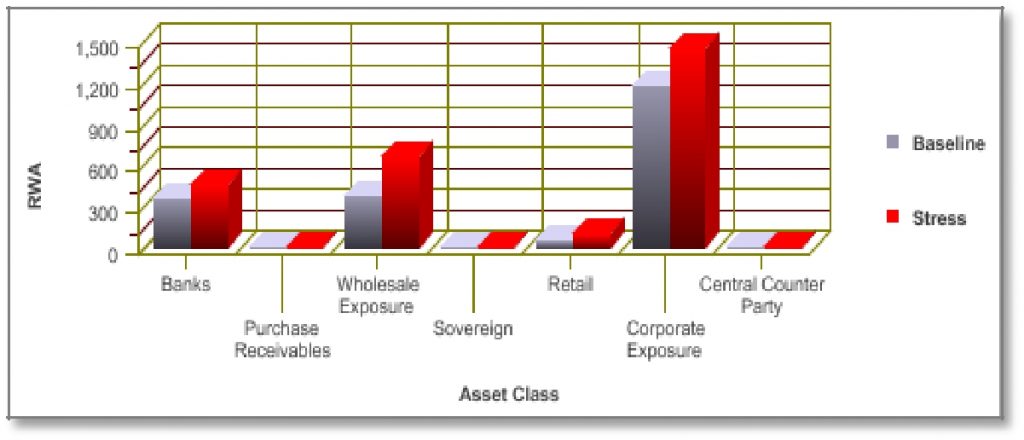

- Supports regulatory capital requirements under baseline and stressed scenarios to optimize capital

- Obtain a complete and analytical view of regulatory capital requirements for strategic capital allocation

- Facilitate compliance with IFSB capital adequacy and Basel guidelines

- Comply with BIS Principles for Effective Risk Data Aggregation and Risk Reporting

Features

- Complete and pre-built Basel II & III solution covering multiple risks, portfolios and asset classes via Standardized, FIRB or AIRB regulatory approaches

- Supports Pillar 3 & regulatory reporting through pre-configured reporting across multiple jurisdictions

- Readily deployable application for compliance with Islamic Financial Services Board (IFSB) guidelines

- Save time and money with a single regulatory solution

- Transparent and complete audit trail for supervisory review

- Integrated stress testing and modeling of multiple risk categories

- Pre-built optimization engine for optimum capital allocation

- Flexible & scalable to handle new business, new products, new entities, new rules

- Comprehensive Modeling Framework

- Unified metadata-driven data management architecture with Open, Pre-Built rule-set and Robust Rule & Run Framework

- Identify changes in key parameters over time, drivers of change, and the change attributed to each driver

![]()